Find Your GREATER Opportunity in St. Cloud!

Opportunity Zones are census tracts designated by state and federal governments for a new economic development initiative that will remain in place for ten years. The 2017 Tax Cut and Jobs Act created this incentive to direct investment into historically disadvantaged communities and neighborhoods. It provides tax benefits to holders of capital gains if they invest in designated zones.

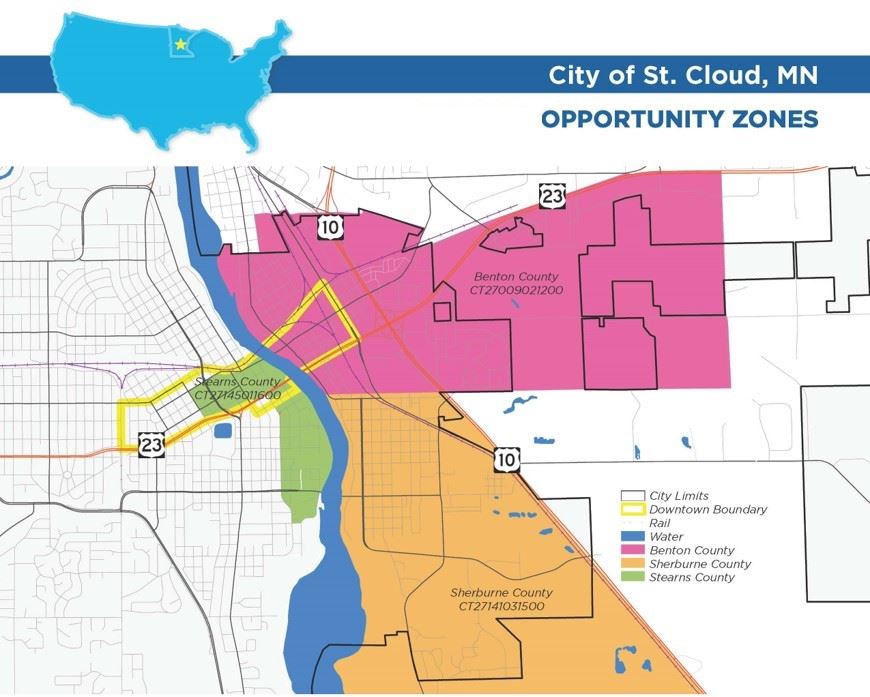

There are more than 8,700 Opportunity Zones in the U.S. Minnesota has 128, three of which are in St. Cloud.

Where are St. Cloud’s Opportunity Zones?

County Zones

Benton County

Sherburne County

Stearns County

What is an Opportunity Fund?

Opportunity Funds are investment vehicles organized as a corporation or a partnership for investing in Opportunity Zone projects or sites. Investments must be made through a qualified Opportunity Fund to qualify for these incentives.

Why Invest in Opportunity Funds?

- Defer payment of capital gains until December 31, 2026.

- Reduce owed tax by up to 15% after seven years.

- Pay zero tax on gains earned from the Opportunity Fund investment.